社区 发现 VAT&海外税务 Tax Obligations on A...

Tax Obligations on Amazon.ca收到加拿大站点提供税号的问题,问了客服,我也没有明白这是像欧洲那样的税号平台收取费用,还是只是出口加拿大需要呀?应该如何解决?

发帖1次

被置顶0次

被推荐0次

质量分0星

回帖互动10次

历史交流热度100%

历史交流深度0%

收到加拿大站点要提供税号的问题,一时半会不知道如何解决,请问大家有遇到这样的情况吗?

加了CASE问了客服,我也没有明白这是像欧洲那样的税号平台收取费用,还是只是出口加拿大需要呀?

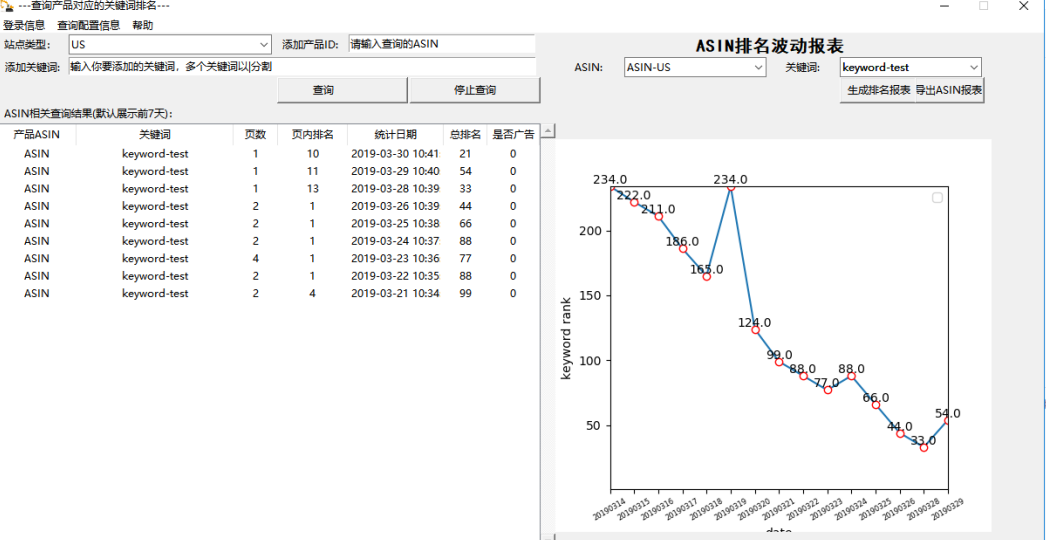

附件有邮件和CASE的相关内容,来大佬指点,谢谢!Your Tax Obligations on Amazon.ca

Greetings from Amazon,

This is an important reminder regarding your responsibility, as a Seller on Amazon, to understand and comply with any Canadian federal and provincial sales tax obligations that may apply to your sales on Amazon.ca. More information regarding your Canadian sales tax obligations, as well as information regarding Amazon-provided tools that can help you manage your sales tax compliance, can be found by visiting Amazon's Seller Central. If you have questions about your sales tax obligations, please contact your professional tax advisor or the tax authorities identified in our help page.

Thank you for being a Seller on Amazon.ca.

加了CASE问了客服,我也没有明白这是像欧洲那样的税号平台收取费用,还是只是出口加拿大需要呀?

附件有邮件和CASE的相关内容,来大佬指点,谢谢!Your Tax Obligations on Amazon.ca

Greetings from Amazon,

This is an important reminder regarding your responsibility, as a Seller on Amazon, to understand and comply with any Canadian federal and provincial sales tax obligations that may apply to your sales on Amazon.ca. More information regarding your Canadian sales tax obligations, as well as information regarding Amazon-provided tools that can help you manage your sales tax compliance, can be found by visiting Amazon's Seller Central. If you have questions about your sales tax obligations, please contact your professional tax advisor or the tax authorities identified in our help page.

Thank you for being a Seller on Amazon.ca.

倒计时:

倒计时:

2 个回复

Jieivan - 峡谷之巅第一货代15999688016

赞同来自: