社区 发现 VAT&海外税务 为什么客户可以直接跳开以没有缴纳VAT费...

为什么客户可以直接跳开以没有缴纳VAT费用的价格购买,这种情况下这个订单我是否还需要缴纳VAT费用?用法国的税率缴费还是用德国的税率缴费?

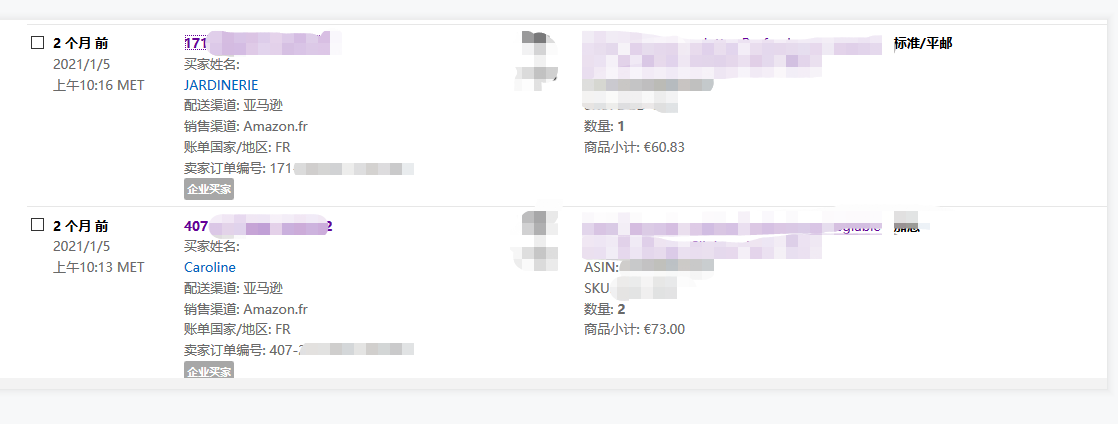

如图1所示,两个订单是完全一样的产品,通过图2可以看到,这款产品如果如果缴纳消费税也就是VAT,亚马逊认为应该是 12.17 (图中显示 24.34 是由于订单2是两个购买),73-12.17=60.83

那么问题是,

1.像图1这种订单,为什么客户可以直接跳开以没有缴纳VAT费用的价格购买,这种情况下这个订单我是否还需要缴纳VAT费用?

2.这款产品我其实是通过德国站发货到法国的,那么假如订单2我要缴VAT费用,我是用法国的税率缴费还是用德国的税率缴费?

谢谢各位大佬热心解答

倒计时:

倒计时:

3 个回复