社区 发现 VAT&海外税务 3月1日晚上收到德国的邮件,让填这份声明...

3月1日晚上收到德国的邮件,让填这份声明。是不是表明,中国直发德国的,是不是不用注册VAT了?

发帖1次

被置顶0次

被推荐0次

质量分1星

回帖互动0次

历史交流热度0%

历史交流深度0%

Dear Seller,

You are required to confirm your DE tax registration status.

According to amended German VAT legislation, online marketplaces must collect a German Tax Certificate from sellers selling from locations in Germany or to customers in Germany if their sales are taxable in Germany and are therefore required to be registered for DE VAT.

If you are not obliged to be tax registered in Germany and are therefore not required to obtain a Tax Certificate, please complete the declaration confirming that you are not generating taxable sales in Germany.

Please complete the following steps before March 10, 2019:Click here to open your declaration form

Answer the declaration question by selecting the appropriate statement

Submit your response

To learn more about the requirements to obtain a Tax Certificate in Germany, click here.

Need help with VAT registration and filing in Germany? Visit VAT Services on Amazon.

Sincerely,

Amazon Services Europe S.a.r.l.

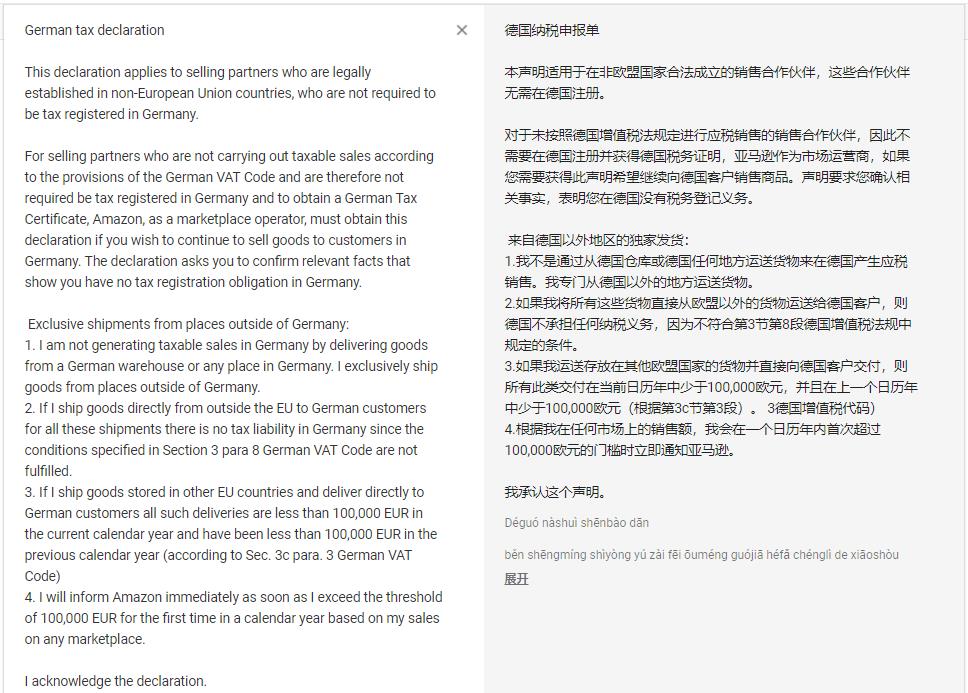

打开邮件里提示的链接,出现这份声明:

是不是表明,中国直发德国的并且年销售额不少过10万欧元,提交了这份声明,就不用注册VAT了?

You are required to confirm your DE tax registration status.

According to amended German VAT legislation, online marketplaces must collect a German Tax Certificate from sellers selling from locations in Germany or to customers in Germany if their sales are taxable in Germany and are therefore required to be registered for DE VAT.

If you are not obliged to be tax registered in Germany and are therefore not required to obtain a Tax Certificate, please complete the declaration confirming that you are not generating taxable sales in Germany.

Please complete the following steps before March 10, 2019:Click here to open your declaration form

Answer the declaration question by selecting the appropriate statement

Submit your response

To learn more about the requirements to obtain a Tax Certificate in Germany, click here.

Need help with VAT registration and filing in Germany? Visit VAT Services on Amazon.

Sincerely,

Amazon Services Europe S.a.r.l.

打开邮件里提示的链接,出现这份声明:

是不是表明,中国直发德国的并且年销售额不少过10万欧元,提交了这份声明,就不用注册VAT了?

倒计时:

倒计时:

18 个回复

JimHuang - 80后创业者,跨境电商知识产权从业者,做困难而正确的事

赞同来自: 小布 、 Sean1115