社区 发现 Amazon 10月发德国HAJ1,FBA22件12月...

10月发德国HAJ1,FBA22件12月到后货值上架1箱,下载了DPD官网的签收单,提交了9月的电子增值税专用发票,亚马逊说我的发票不能用?

发帖53次

被置顶6次

被推荐1次

质量分0星

回帖互动398次

历史交流热度44.37%

历史交流深度0%

✨

AI 摘要

适合在亚马逊FBA运营、遇发票合规与缺货核验的跨境卖家查阅。

本文围绕在亚马逊FBA与德国发货场景下,发票日期、地址信息、签收单及缺货证明的合规与取证难题展开。

1.

发票时效与日期匹配:

亚马逊要求发票日期在发货前,9月发票不符合10月出货的情形,需获取发货前的原始发票以证明时间线。2.

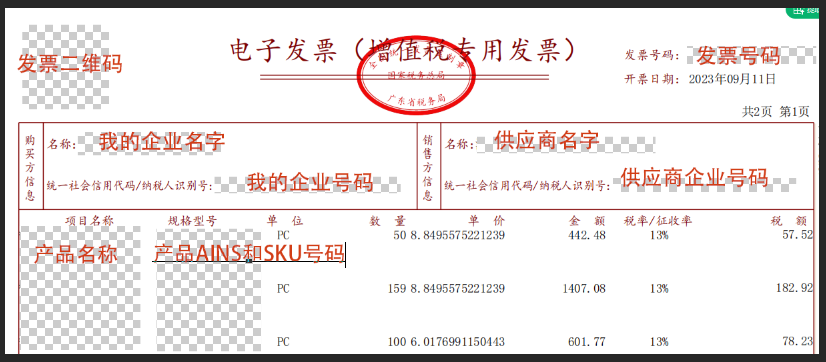

信息字段完整性:

电子增值税专用发票缺少地址和电话字段,仅有企业名与纳税人识别号,难以满足平台的完整信息要求。3.

数量与缺货证据:

提供的发票数量多于实际出货件数,需提交所有缺失单位的原始购买凭证或所有权证明以便核验。4.

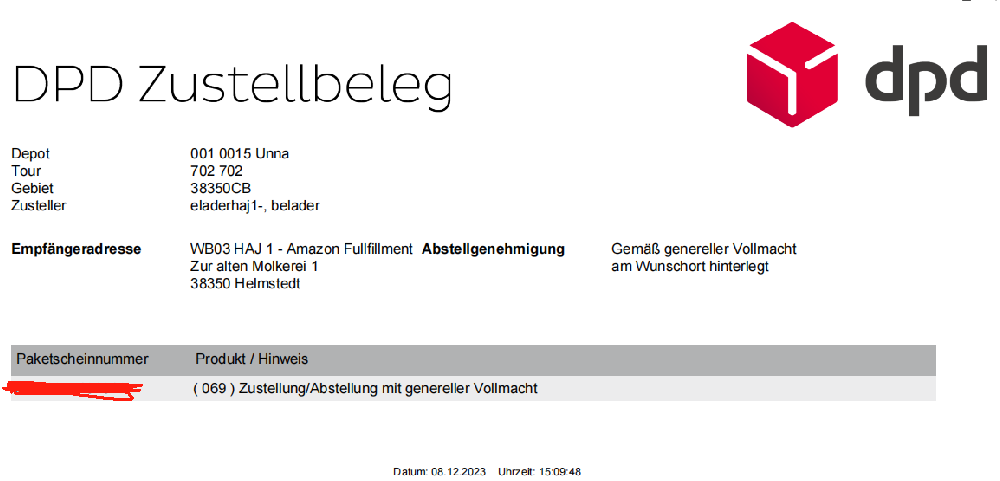

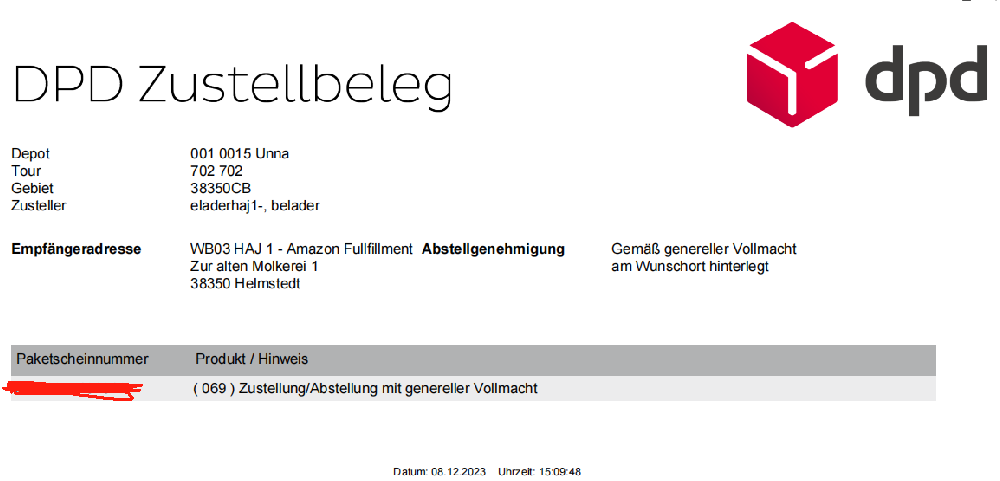

物流凭证一致性:

DPD 签收单与主单签收状态不一致,需确保签收凭证与主单一致以支持核验。5.

官方发票要素:

亚马逊要求原始发票含日期、货品名称、数量、开票方全名与地址、买方信息等,且不得修改。6.

解决路径与对策:

建议联系供应商索取含地址与电话的发票,保留未修改的原件扫描件,并提供完整购买凭证和所有权证明以继续审核。

✨

AI 摘要

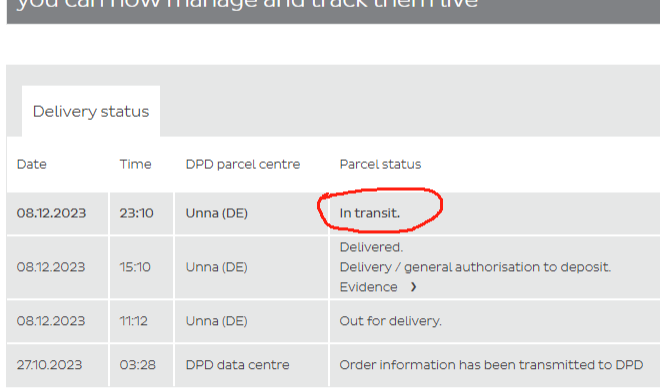

10月发德国HAJ1,FBA22件12月到后货值上架1箱,下载了DPD官网的签收单,提交了9月的电子增值税专用发票,亚马逊说我的发票不能用?说我的发票需要日期是发货前的,我也奇怪9月的发票,10月发货为什么不是之前?还有就是现在的电子专用发票没有地址和电话号码,只有企业名字和号码。下面图片是货代在dpd官网下载的签收单,22件货只有21张子单的签收,主单还没有显示签收。

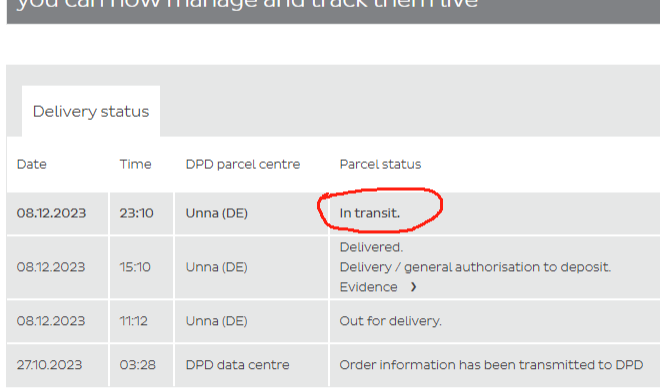

但是我去官网查显示是下面的

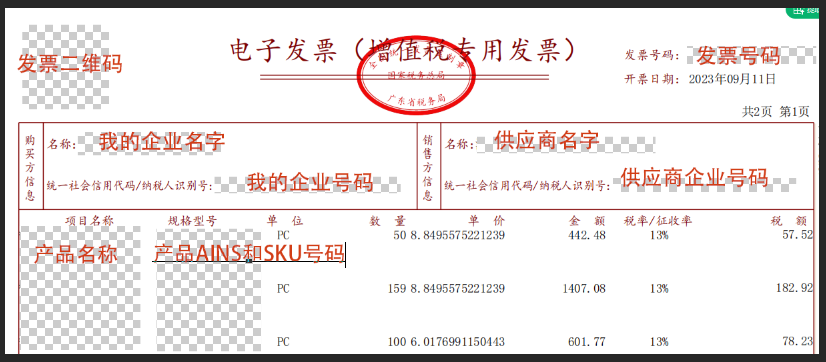

我提供了2023年9月的电子增值税专用发票,但是电子发票没有显示地址和电话号码。只有企业名字和企业号码。我的数量都是比发货的多。亚马逊回复需要我提供的发票是发货之后的?下面是亚马逊的邮件。

Please note that the invoice you have provided is not valid because the invoice date is after the shipment is shipped. To continue the investigation, proof of ownership is required for all missing units you have reported. Please provide us with all proof of ownership for these items so that we can continue reviewing your request. NOTE : Do not modify the invoice please scan and send the invoice. Please provide relevant official purchase invoices for the units that you've reported missing from this shipment. To proceed with my investigation, please provide the proof of purchase or ownership for the inventory that you’ve asked me to investigate. Note: The proof of purchase must be the original invoice from the supplier or manufacturer and must include the following information: - Date of the purchase - Product names of the missing items - Quantity bought - Full name and address of the invoice issuer - Full name and address of the buyer The purchase price isn’t required and can be concealed.

但是电子增值税专用发票是没有地址和电话号码的。不能用吗?

请问大佬们有没有遇到这样的情况怎么处理?

下面是我的发票格式

但是我去官网查显示是下面的

我提供了2023年9月的电子增值税专用发票,但是电子发票没有显示地址和电话号码。只有企业名字和企业号码。我的数量都是比发货的多。亚马逊回复需要我提供的发票是发货之后的?下面是亚马逊的邮件。

Please note that the invoice you have provided is not valid because the invoice date is after the shipment is shipped. To continue the investigation, proof of ownership is required for all missing units you have reported. Please provide us with all proof of ownership for these items so that we can continue reviewing your request. NOTE : Do not modify the invoice please scan and send the invoice. Please provide relevant official purchase invoices for the units that you've reported missing from this shipment. To proceed with my investigation, please provide the proof of purchase or ownership for the inventory that you’ve asked me to investigate. Note: The proof of purchase must be the original invoice from the supplier or manufacturer and must include the following information: - Date of the purchase - Product names of the missing items - Quantity bought - Full name and address of the invoice issuer - Full name and address of the buyer The purchase price isn’t required and can be concealed.

但是电子增值税专用发票是没有地址和电话号码的。不能用吗?

请问大佬们有没有遇到这样的情况怎么处理?

下面是我的发票格式

倒计时:

倒计时:

6 个回复

匿名用户

赞同来自:

你这情况就是没用对公账户导致的,但是发票是可以用的

为什么亚马逊回复需要我提供的发票是发货之后的?

亚马逊就是不想赔偿,想拖着,看看后面你的货能不能找到,老套路了

继续开case据理力争呗

告诉亚马逊你的发票是在货之前的,是属于中国法律认可的发票,是需要缴纳税务的

匿名用户

赞同来自:

你这情况就是没用对公账户导致的,但是发票是可以用的

为什么亚马逊回复需要我提供的发票是发货之后的?

亚马逊就是不想赔偿,想拖着,看看后面你的货能不能找到,老套路了

继续开case据理力争呗

告诉亚马逊你的发票是在货之前的,是属于中国法律认可的发票,是需要缴纳税务的